Advisory

Supporting your clients through a 2021 recovery - webinar

18 Jan 2021

On the 13th January 2021, our Head of Sales Ryan Hyde-Smith and Advisory Partnerships Manager Luke Bowmar hosted a webinar in conjunction with the IFA to discuss the impact Covid-19 has had on the current lending market. The webinar also covered how we can support your clients through a 2021 recovery as well as how we work with our introducers.

Market impact of Covid-19

Impact on customers

Small to medium size enterprises and SMEs account for over 50% of the total revenue generated by UK businesses and these businesses employ 44% of the workforce. It is therefore no surprise that Covid-19 has had a significant impact on SMEs. The SME population has felt the brunt of the economic impact as a result of the various lockdowns and restrictions throughout 2020 and continuing into 2021. The combination of these factors created a sudden drop in revenues for businesses and for some it has created liquidity shortages.

This drop in revenue has been seen across all industries, resulting in a greater need for borrowing. Additionally, demand in borrowing has been accelerated by the government assisted lending schemes such as CBILS and BBLS which account for a large percentage of our customer loan requests.

There has also been a significant shift in customer expectations when it comes to lending. Typically, in times of economic uncertainty, especially with unsecured loans, funding credit becomes difficult to obtain and interest rates move in line with that. However, as a result of the government support throughout Covid-19 and the extension of their various loans, clients have increasingly become rate conscious and understandably less comfortable when it comes to personal guarantees.

Impact on lenders

CBILS accredited lenders have had to alter their underwriting criteria to adopt BBB lending regulations, which has resulted in less variance across panels. Outside of CBILS accredited lenders, lenders have seen a restriction in their criteria and an increase in interest rates.

Perhaps one of the silver linings of Covid-19 has been the acceleration of technology-lead underwriting from lenders. For example, one of our key partners has successfully rolled out auto decisioning for up to £100,000 which has seen us being able to enter new territories when it comes to decision making which will continue to stay post-Covid. Another change we have seen from our lenders, has been the increased focus on providing flexible payment options to customers. Flexible payment options such as payment holidays for up to three, six or 12 months has been a great respite to the cash flows of lots of customers'.

Red house with keys

Current lending market

Unsecured market

The changes in the lending market has reduced the lending ability over the past nine months, resulting in some considerable changes in the lending landscape. During lockdown 1.0, the changes happening were almost daily, but this has since stabilised with the reopening of the economy and the government supported lending schemes such as CBILS and BBLS.

Requests for these government supported loans account for around 65% of customer loan requests we see coming in. Since March 2020, we have partnered with over 40 accredited lenders on the CBILS panel with providers across property finance, asset finance, unsecured finance and invoice finance.

The number of applications and funded customers of non-CBILS loans are increasing MoM, which will hopefully continue to accelerate as the CBIL scheme winds down in Q2.

Property market

The property market experienced a slower recovery than the unsecured and asset markets. During the first lockdown back in March 2020, the majority of lenders were significantly reducing their commercial mortgage LTV, with some lenders LTV falling below 50%. This, combined with some banks being unable to complete on-site property valuations stalled the number of property purchases that were able to happen until restrictions were lifted. Since then, there have been some positive advancements with development finance, bridging loans and commercial mortgages, with commercial mortgage LTV having now returned to pre-COVID levels of 75%.

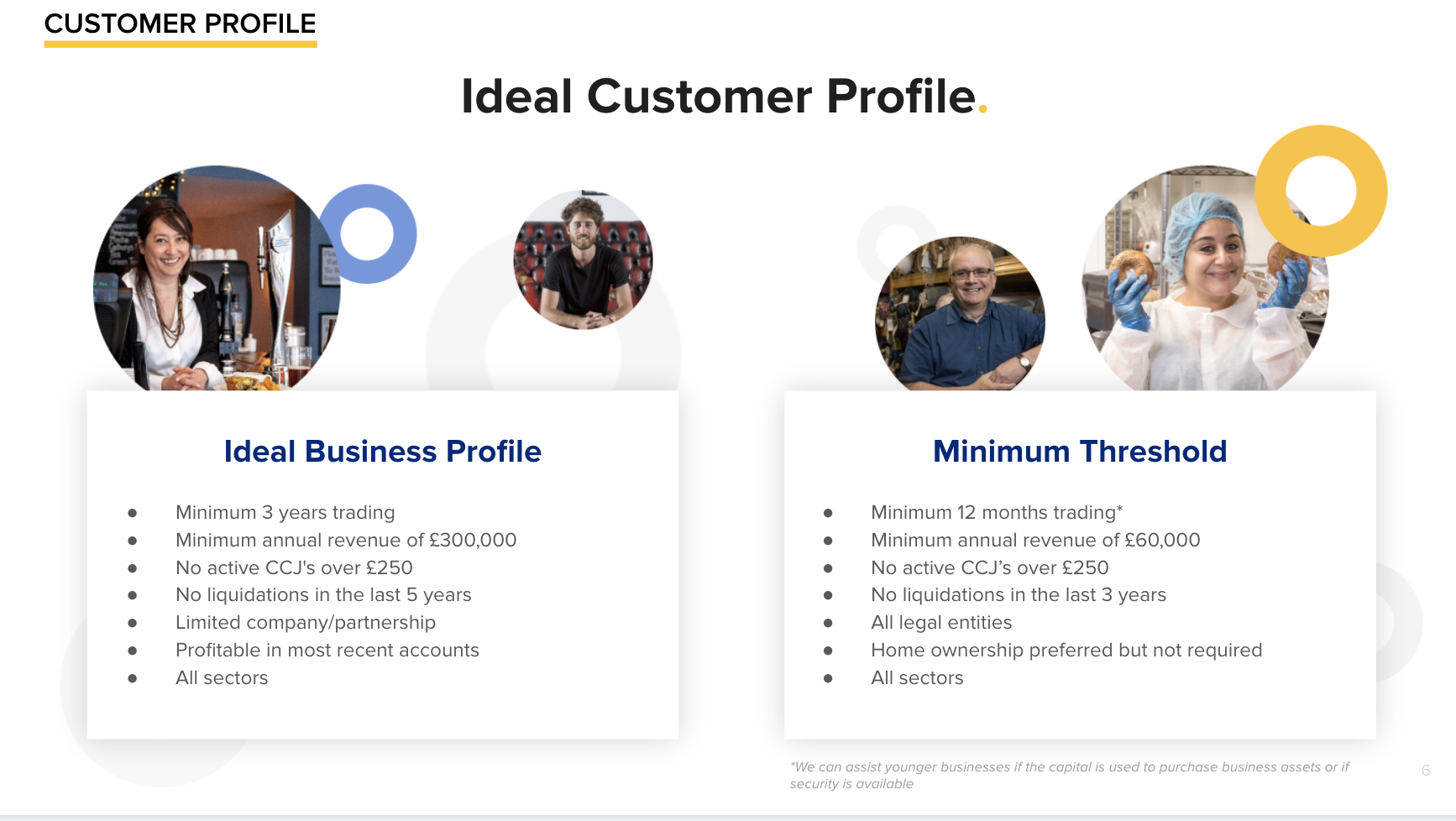

Ideal customer profile

Discover the ideal customer profile and minimum threshold required from lenders, which should help guide you with what lenders are looking for.

Types of finance available

We are currently unable to assist with Bounce Back Loans. This facility is largely not on offer in the alternative finance market because it is easy to access from high street banks.

If you missed the webinar or want to watch it in full again, you can find it here. Alternatively reach out to Luke Bowmar at [email protected]/ 07950849421 if you have any questions relating to partnerships and want to partner with us.

Subscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.